Whether you’re a student, young professional, or navigating a career change...

You’re in the right place!

What You’ll Unlock Inside This Course

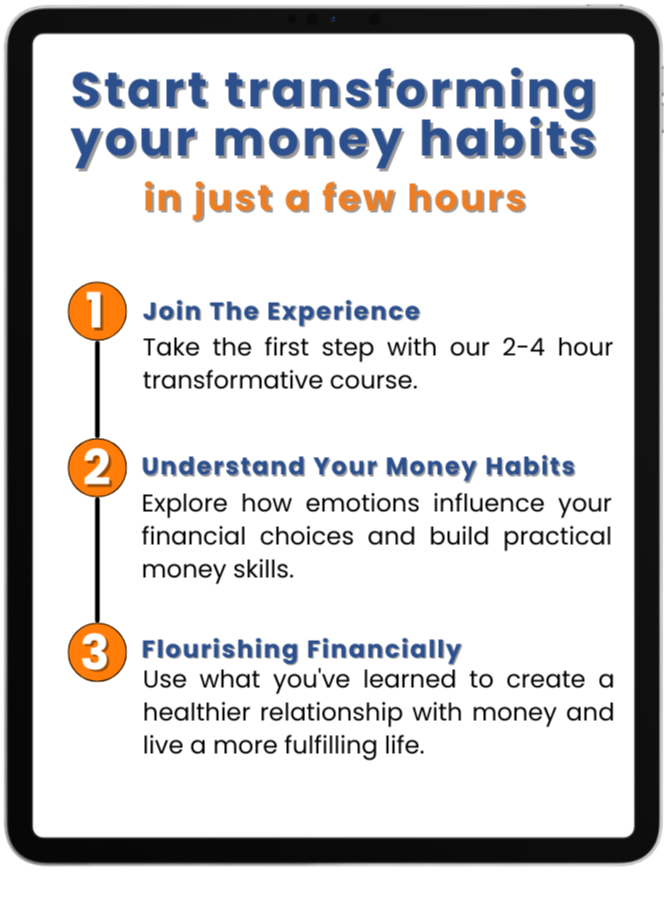

Ready to transform your relationship with money?

💬 Trusted by Educators, Leaders & Coaches!

What You Will Gain From This

Who This Course Is For

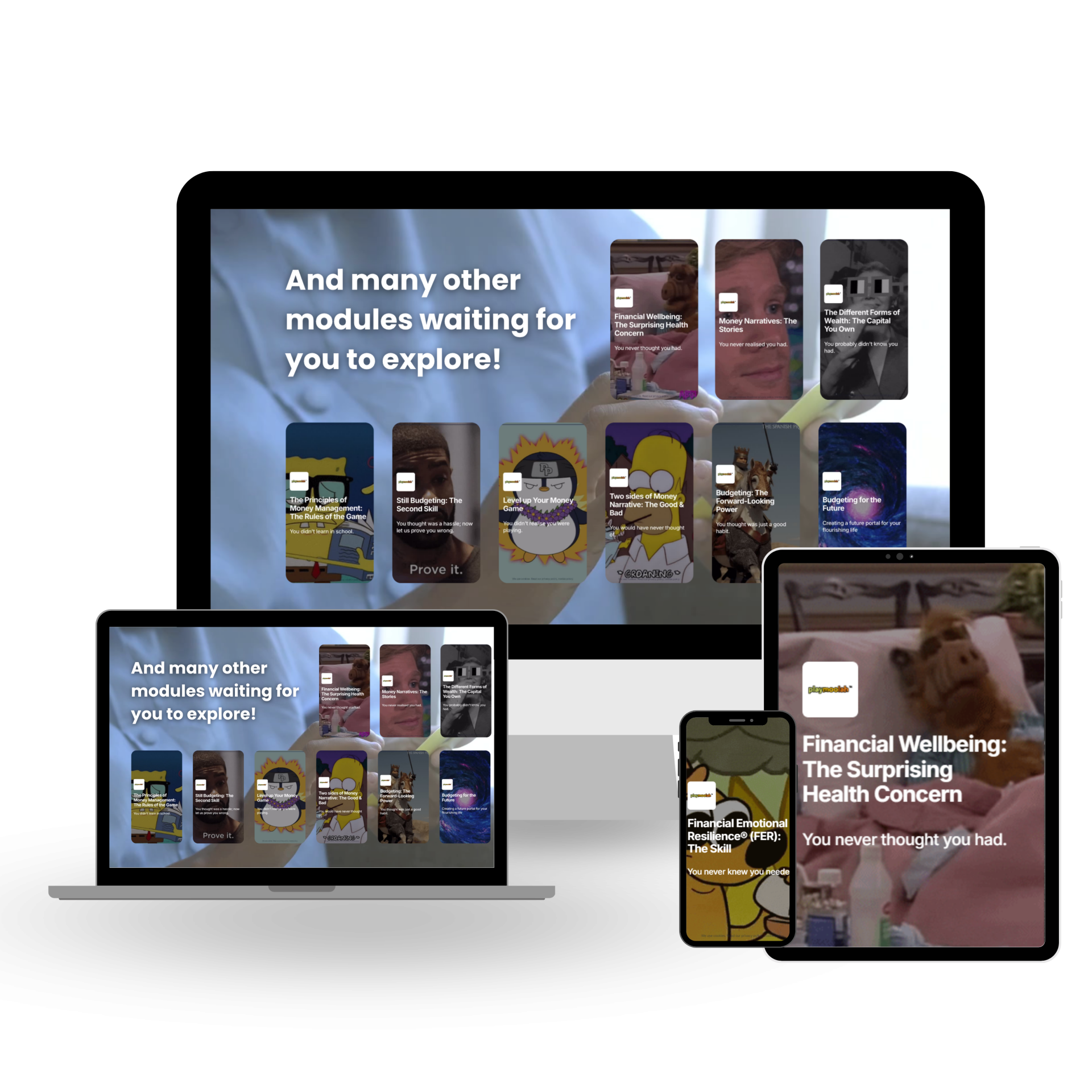

What’s Inside

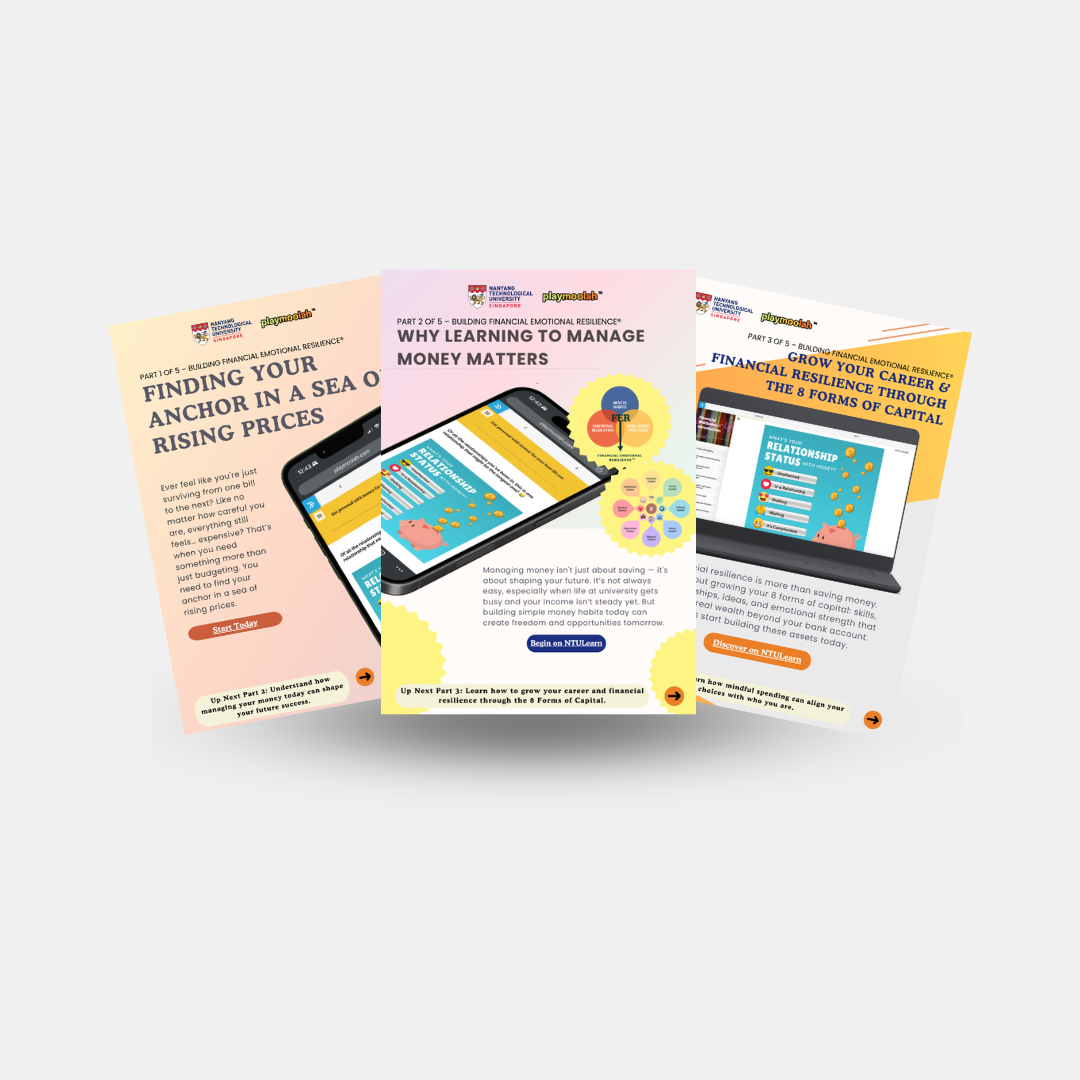

Financial Wellbeing – Introduction Module

When You Enroll Today, You’ll Receive

Meet Your Guide