Building Financial Emotional Resilience®

We're the movement that's shifting how people

think

feel

act

around money.

Our Manifesto

For the ones who've carried money shame and financial fear.

For the ones told they're "bad with money." For us who have

seen our families fight over money because of lack of or

because of its. For the ones who deserve to flourish

financially and emotionally.

Our Journey Since 2010

We've discovered that true financial wellbeing isn't just about budgets and investments. It's about transforming the deep-seated emotions, beliefs, and narratives that drive our financial behaviours.

Today, we work with diverse communities worldwide, creating lasting change in how people relate to money and build resilience in their financial lives.

OUR DEFINITION OF WEALTH

*firstly introduced by Ethan Roland and Gregory Landua

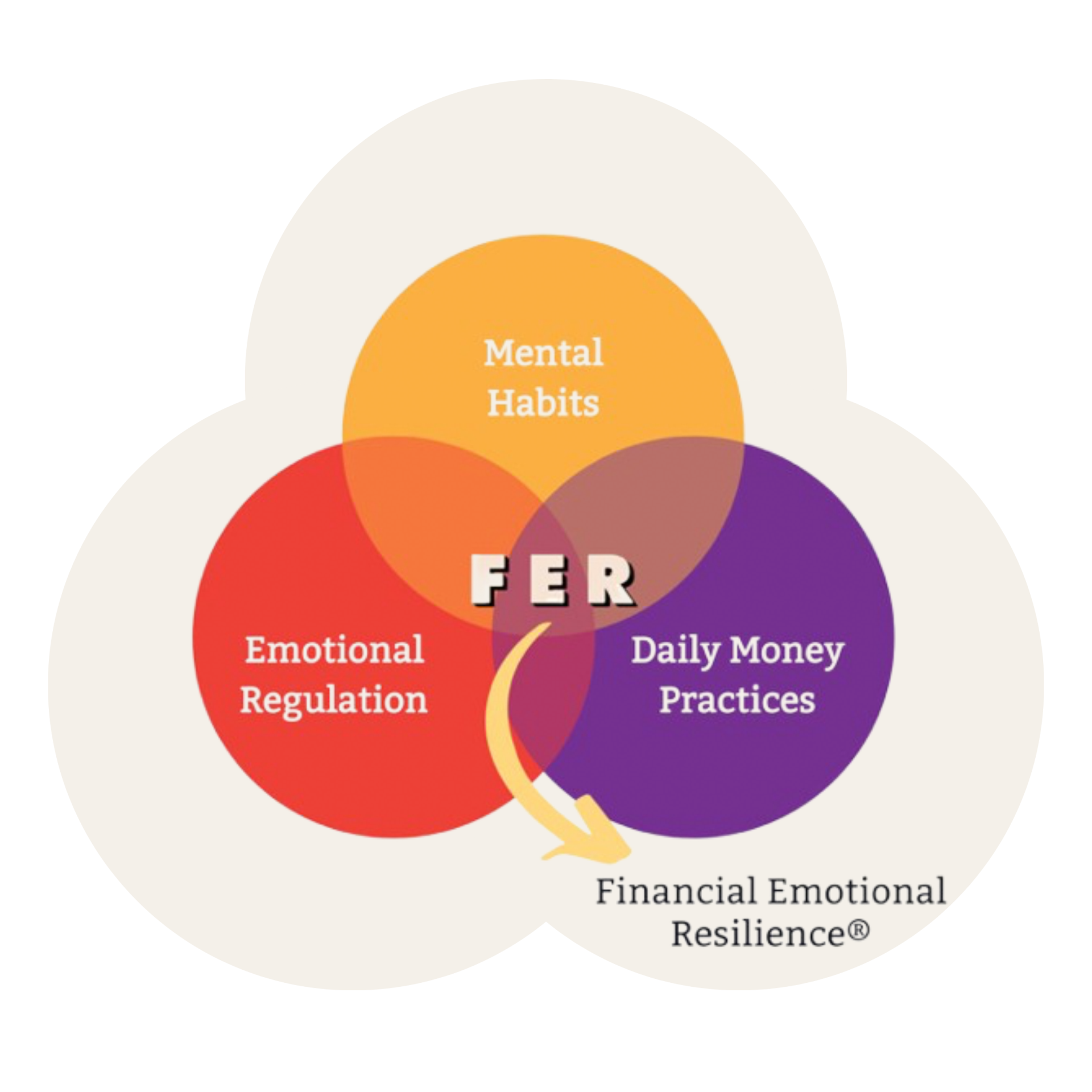

FINANCIAL EMOTIONAL RESILIENCE®

Our renewed focus represents a paradigm shift in financial education. We've moved beyond traditional financial literacy to address the emotional and psychological aspects of money management.

OUR IMPACT IN NUMBERS

OUR PURPOSE

OUR PURPOSE

MISSION

MISSION

VISION

VISION

COMMUNITY IMPACT

COMMUNITY IMPACT

"PlayMoolah helped me understand that wealth isn't just about money—it's about building all forms of capital. My whole perspective changed."

- SARAH, 28

"The financial emotional resilience approach transformed my relationship with money from fear to empowerment. I'm no longer paralysed by financial decisions."

- MARCUS, 34

"This isn't just financial education—it's life transformation. I now see how my social, creative, and spiritual capital all contribute to my wealth."

- PRIYA, 42

Audrey Tan

Join the Movement

Who we are

A Brand of The Moolah Group

A Partner Company to The Wealth Resilience Institute

Get in touch

-

10 Anson Road, #44-12,

International Plaza,

Singapore 079903 -

info@playmoolah.com