Do you find yourself fighting, arguing, getting annoyed with your spouse, boyfriend, children or parents about money? Walking away from the fight not having any clear resolutions or perhaps never ever bringing up that topic, ever again? Why do we fight about money? Why is it a source of tension, what really are we fighting about?

1. Understanding my narratives around money —

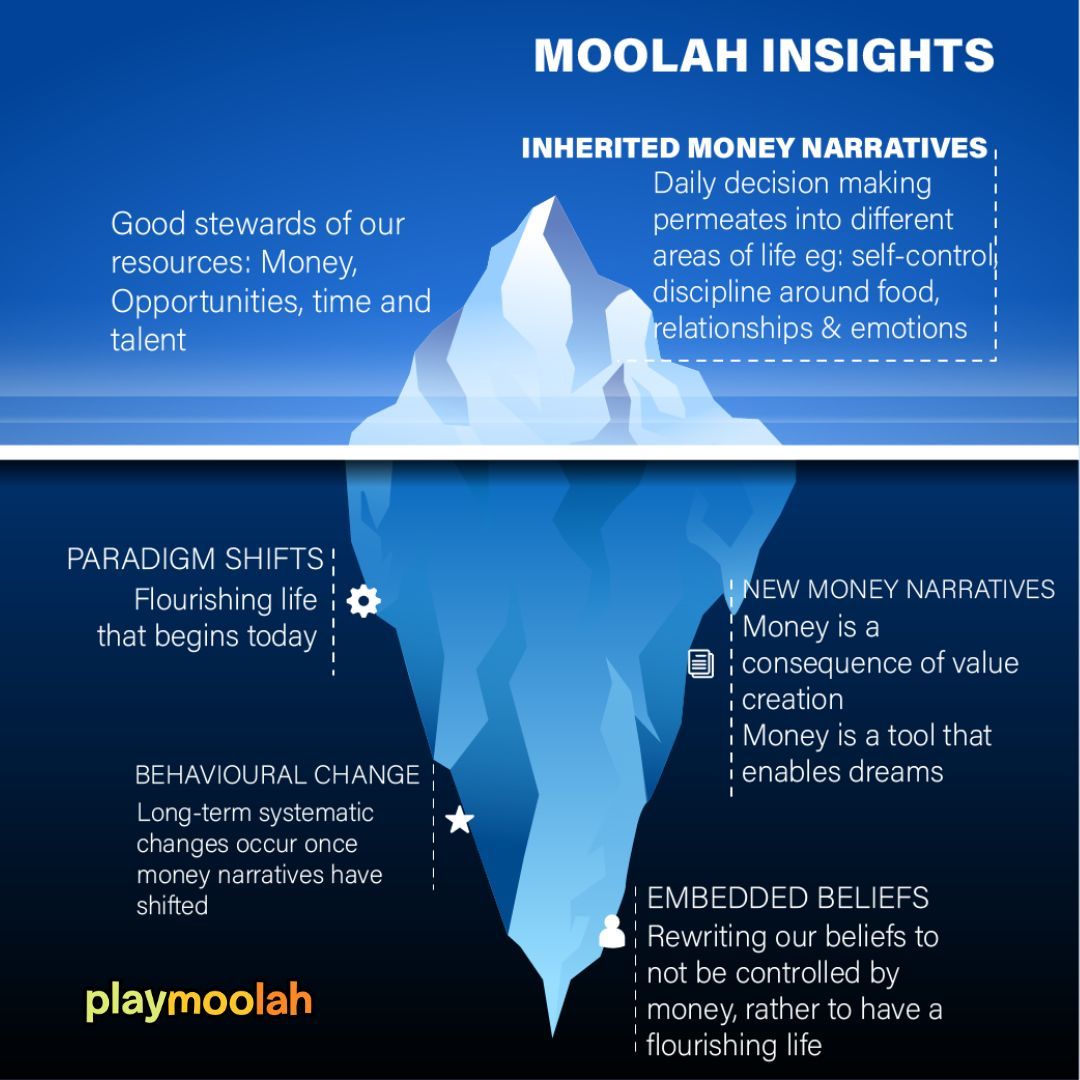

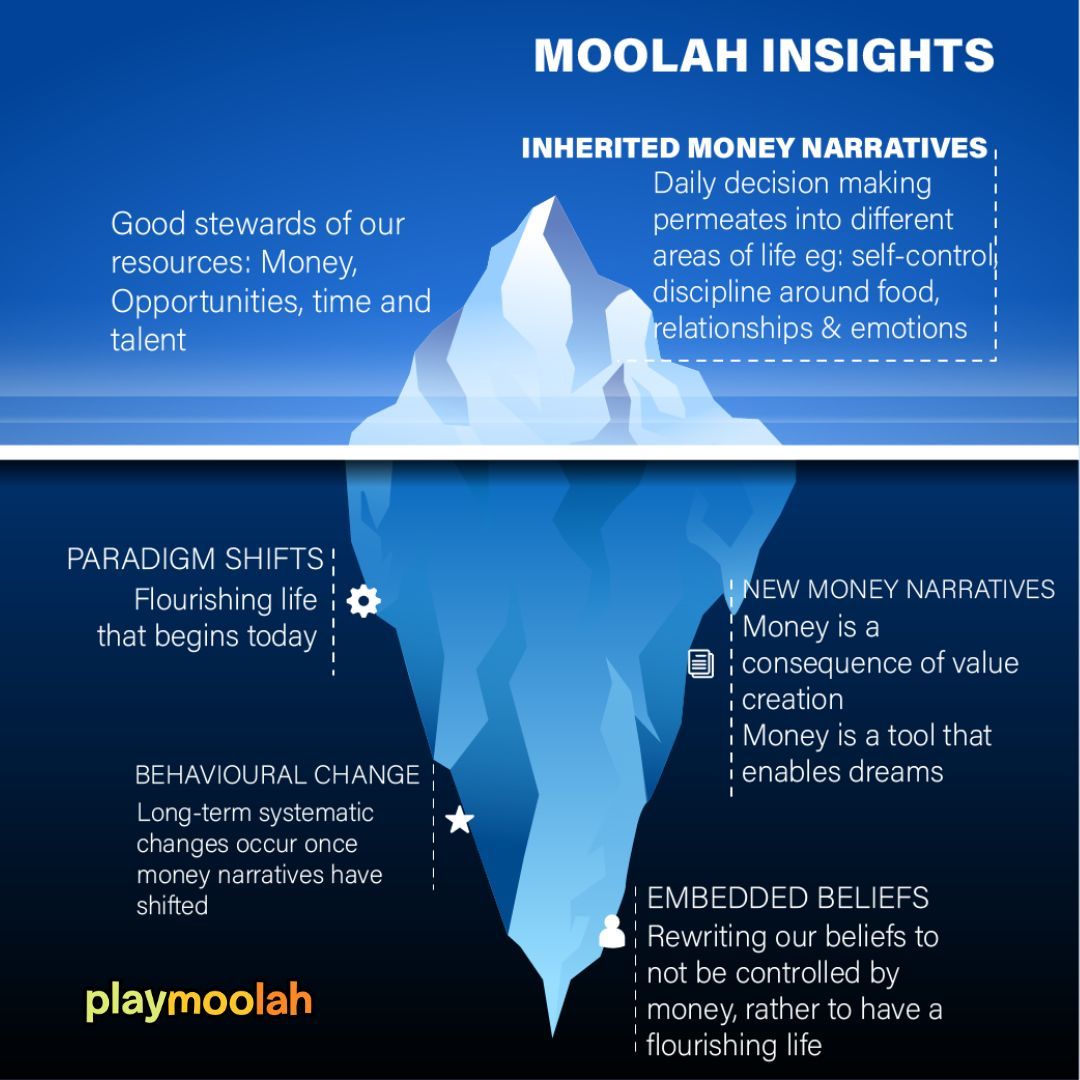

Having a visual picture of what narratives to money I have. With that clear in your head, it helps one to understand what are the underlying narratives drive you. Take for instance, “Money is never enough”, “I hate money”, “Money is security, for saving”, “Money is power” or “Money is the root of all evil”, these scripts form the foundation of how one relates to money. They end up unconsciously being the lens of how we see the world and affects how we judge the actions of our spouse, partner or loved ones. Perhaps even of how we judge ourselves!

We need to realise that what we see is often time on the surface, and the way to understand transformative change is to first take a look at the deeper layers where our values, beliefs are held. The past experiences and the narratives we hold allow us to touch the heart of the issue instead of reading what’s generally on the surface.

The money narrative that was passed down to me by my father was that it is a gift and a means to an end. He was always generous and didn’t care too much to “store” for the future. For my spouse, money is security and power. Hence when we have a fight around money, it often leads to a gridlock as we fail to understand what’s underlying it.

2. New money narratives, new paradigm shifts--

They emerge when we:

a) have too much pain, at a breaking point and we’ve come to realize that the old scripts, no longer serve us

b) we are tired of the fights, tensions and arguments in our relationships that we now feel it’s time for change

c) have been the source of our tensions, recognizing that money is the trigger most of the time for what’s really beneath the surface. The truth is, the tensions in relationships are often rooted in the inability to trust, the lack of security, expectations of my partner, mindset of scarcity, feelings of insufficiency, envy, or even that money equates to power.

I’ve come to realiZe that, we can recreate and redefine some of these narratives around money for ourselves and the next generation.

Here are the money narratives of the collective wisdom that have empowered people and relationships.

Empty space, drag to resize

Money is a tool for a purposeful life

Money is a gift, for stewardship

Money is a consequence of an exchange of value creation

Money used is used to invest in the good of relationships, in people, society and for the planet

Money enables others positively

Money enables dreams

Empty space, drag to resize

Here’s how I have recreated my money narrative from “money is a gift” to “money enables dreams”. I also see myself as the steward of resources, namely money and time as they have the same value to me.

My 7-year-old recently expressed that she has a dream of living in a big house where everyone can be together. When I heard that, it gave me a purpose to work hard and earn more money so that this dream can be realized. While I never had that dream for myself, it now becomes a family dream. Through this experience, I learned that I can’t accept the narrative that money is safety (my spouse’s) but I can certainly accept the new narrative that money enables dreams and that I am a steward of money. It is up to me how to manage it in order to reach our family potential and dreams.