During the war, my grandfather made a lot of “banana money”. He apparently had so much money due to hyperinflation that it filled a whole cupboard. When the occupiers left, all that banana money became worthless. This taught me my first lesson on what money really is.

Today, the total amount of money in the world is about $60 trillion, yet physical coins and notes account for less than $6 trillion. Money’s worth goes beyond its chemical structure in metal or paper, and today exists mostly as electronic data that sits and moves from one computer server to another. Money isn’t a material reality – it is a mental construct, with trust as it’s core.

"Money is the most universal and most efficient system of mutual trust ever devised. Even people who do not believe in the same god or obey the same king are more than willing to use the same money.

What created this trust was a very complex and long-term network of political, social, and economic relations. Why do I believe in the gold coin or dollar bill? Because my neighbors believe in them. And my neighbors believe in them because I believe in them. And we all believe in them because our king believes in them and demands them in taxes, and because our priest believes in them and demands them in tithes."

Empty space, drag to resize

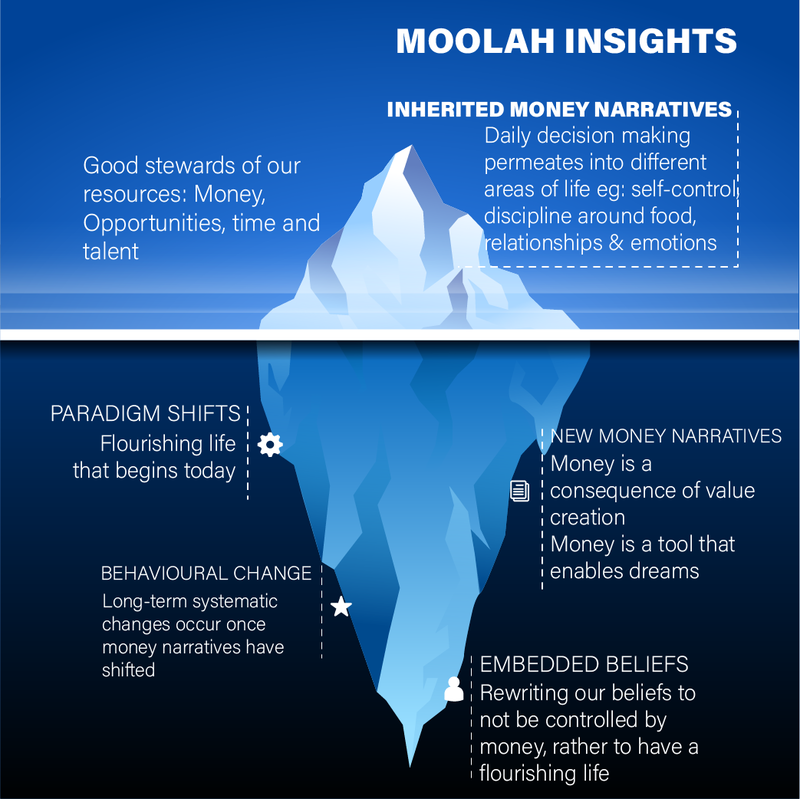

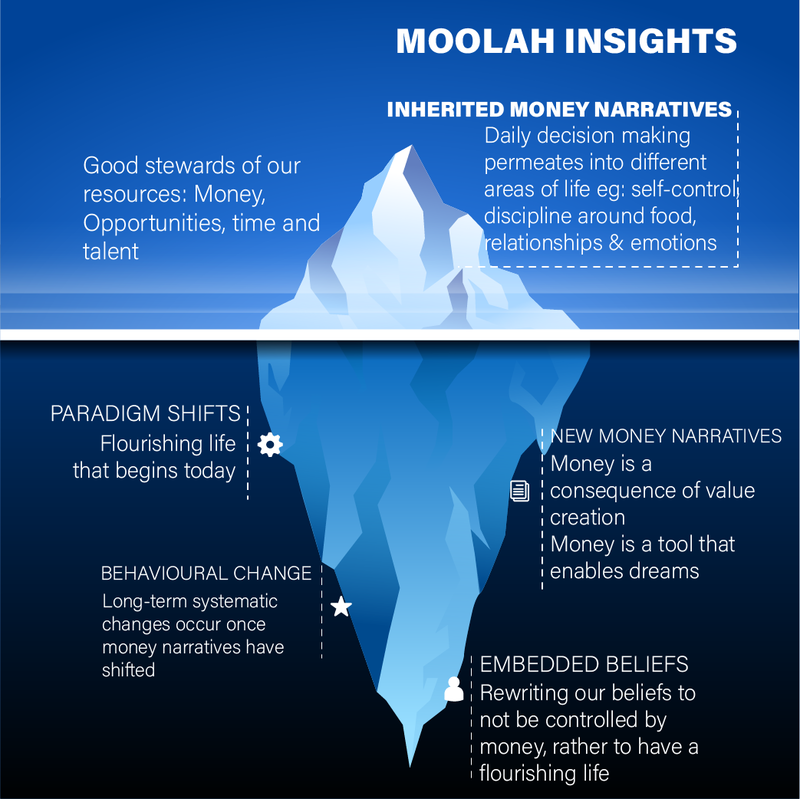

Money is hard to think about because it can be used for almost everything today, and embeds many layers of complexity. Because it ties so tightly to the exchange between human relationships, it is also where our identity, aspirations, values, and beliefs, emotions are played out.

As such, money can trigger feelings of anxiety, fear, or even disgust. It is natural to want to avoid thinking about it as much as we can. A healthy relationship however, requires us not to turn away from it, but to turn towards it. Our first step to understanding involves giving attention to what is really going on, and examining our patterns of thinking and scheme of values as it relates to money – what does it really mean to me? What is it’s role in my life? What is it’s role in my relationships? Once we apply a new observation, we gain genuine self-knowledge that may be uncomfortable at first, but freeing the more we develop clarity.

Empty space, drag to resize

One thing that’s characteristic of a good relationship is this – we get more accurate at assigning responsibility. When things go wrong, we can see how much is our fault and how much is the fault of the other person. And the same holds when things go well.

This model applies to money. For example, when we worry or feel stressed about money, it usually is because we cannot answer these questions with specificity – What do I need money for, and when? How much is enough? How can I get that money? The problem then is not of money but in our own clarity of what we really want out of life.

When things go well or badly, it’s partly about what we bring to the situation and partly about what money brings. What money brings is a certain level of spending power. What we bring to this relationship includes imagination, values, emotions, attitudes, ambition, fears. So the relationship is absolutely not just a matter of pure economic facts, but an invitation to transform our future by giving money our mindful attention, deepening our inquiry, and living consciously through our actions.