Financial Emotional Resilience as Preventive Healthcare

Money is a tool for a flourishing life. Money can enable dreams. Money can be used to benefit people, families, organisations, societies and the planet. What does your flourishing life look like? Money can be a tool to enable us to live our flourishing life. In our first publication in 2021, we explored the models of resilience, the 8 forms of capital and what financial emotional resilience is.

Financial Emotional Resilience is preventive healthcare.

What is the connection between money and health? Data has shown that there is a connection between Financial Stress and Health. Financial stress has profound implications for mental, social, emotional, physical and spiritual health. Research has shown that financial stress can impact have both physical and mental well-being. Persistent worry about bills, debt, and meeting basic needs can result in anxiety, depression, and even chronic health conditions such as hypertension and cardiovascular diseases. Financial strain can lead to psychological distress and other mental health impacts.

Singapore launched the National Mental Health and Well-Being Strategy earlier this month, which aims to tackle mental health holistically through preventive and curative approaches. PlayMoolah believes that this strategy addresses the urgent need to take action and arrest the decline in mental health, especially among the youth.

Singapore launched the National Mental Health and Well-Being Strategy earlier this month, which aims to tackle mental health holistically through preventive and curative approaches. PlayMoolah believes that this strategy addresses the urgent need to take action and arrest the decline in mental health, especially among the youth.

Financial well-being is a crucial aspect of holistic wellness. Just as proper nutrition and exercise can prevent physical ailments, maintaining a healthy financial life can be a powerful preventive measure for overall health and well-being. In this article, I share PlayMoolah’s vision of Financial Emotional Resilience (FER) to illustrate how it is intricately linked to preventive healthcare and contributes to a flourishing life.

Understanding Financial Well-being

Here at PlayMoolah, we think that financial well-being goes beyond having a stable income or a high-yield savings account. It encompasses the ability to manage daily finances, handle unexpected expenses, save for future goals, and invest wisely. When an individual achieves financial well-being, they experience reduced stress, improved mental health, and an increased sense of agency in their life.

Financial Emotional Resilience (FER)

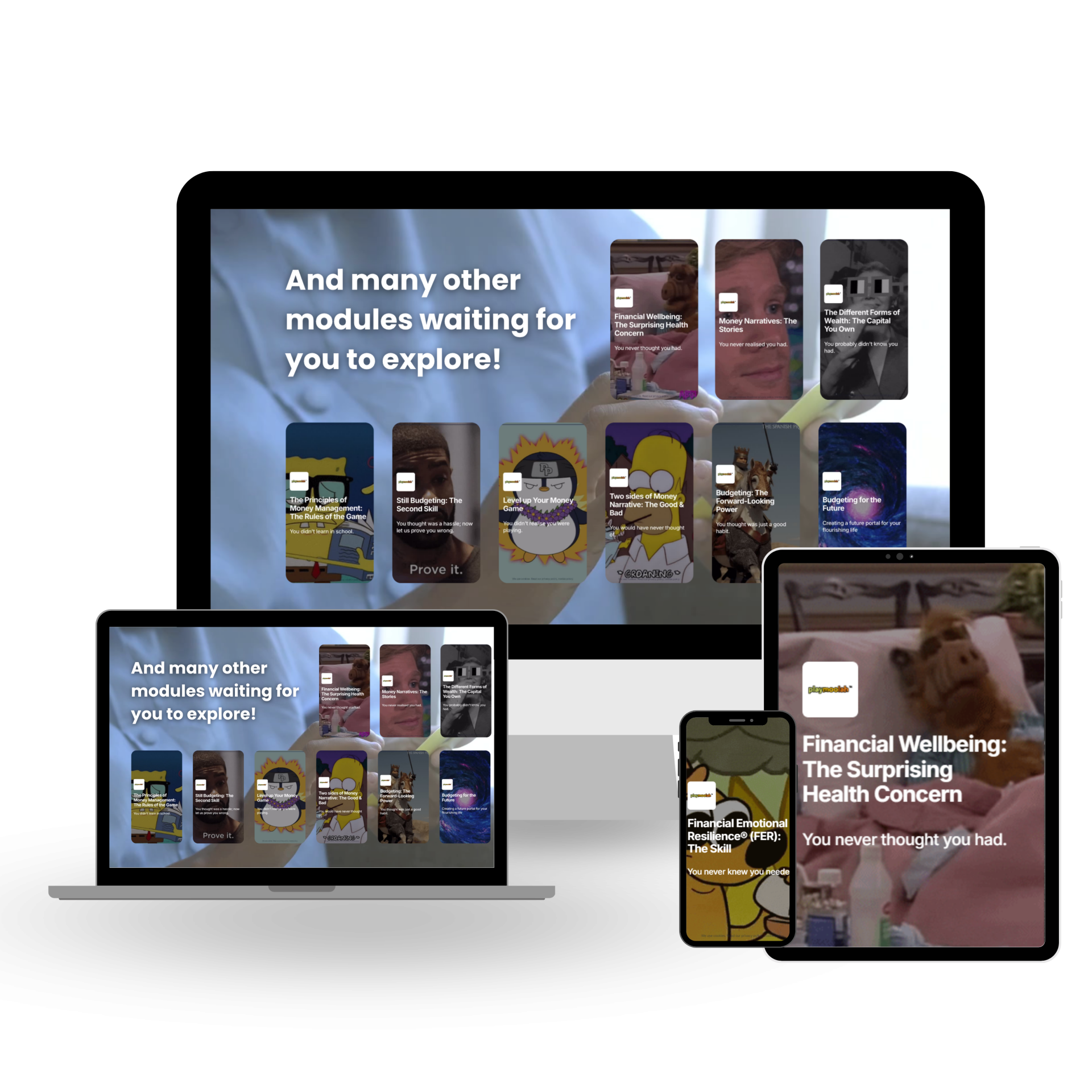

PlayMoolah believes that Financial Emotional Resilience (FER) contributes to financial well-being and can be seen as preventive healthcare. FER goes beyond financial literacy, as it includes the dimension of mental well-being and fortitude.

PlayMoolah defines Financial Emotional Resilience as the ability to adapt, change, and modify positive emotions, daily practices, and actions in our financial decisions.

PlayMoolah defines Financial Emotional Resilience as the ability to adapt, change, and modify positive emotions, daily practices, and actions in our financial decisions.

FER is the outcome of one’s inner strength (mental, physical, spiritual, emotional) transforming negative money beliefs, narratives, thought patterns, emotions, and behaviour, into positive enabling ones in relation to money decisions. Educating individuals about budgeting, saving, investing, managing debt through emotional regulation, and crafting resilient money narratives would enable our young people to make informed decisions about their financial future for themselves and the generations to come.

FER programs can be integrated into schools, universities, workplaces, and communities to equip people with the skills to navigate personal finance and harness healthy money habits for a flourishing life. We need to go beyond financial literacy. As the saying goes, if you do not disrupt yourself, you will be disrupted. What if we looked at disrupting financial literacy for greater effectiveness? Can we rethink and begin to include financial emotional resilience as a key component of successful discernment and decision making?

Financial Emotional Resilience for Healthier Individuals, Society and Planet

Similar to how a well-structured healthcare plan helps individuals maintain their health, thoughtful financial design can serve as a safeguard against financial troubles. Financial design can comprise having sufficient emergency funds for rainy days, securing adequate insurance coverage, and advance planning for requirements.

Through well-calibrated financial design and planning, individuals possess peace of mind, which contributes to their overall mental health and well-being. Building a solid financial plan offers individuals peace of mind, contributing to overall mental health and well-being. Our society also benefits from having individuals build their financial plans to withstand the shocks and uncertainty that unexpected life events may bring. When we begin to identify the negative money narratives, we are able to identify the “diseases” or limiting beliefs around money we carry in our bodies, hearts and minds. Can negative money narratives be seen as a virus we spread to our cells and even to the next generation?

Good financial design creates opportunities, and money can be used as a tool for opportunity, a propeller to new beginnings that can give people agency and hope. We are stewards of resources and the 8 forms of capital, as we learnt in permaculture.

We can begin to use money as a tool for the flourishing of people, society and the planet! When we are good stewards, we enlarge opportunities and increase and make available resources.

We can begin to use money as a tool for the flourishing of people, society and the planet! When we are good stewards, we enlarge opportunities and increase and make available resources.

This is a preventive measure of inequity. Can we begin to think and use money differently? When individuals flourish, society thrives and we begin to make better decisions that take care of our planet.

Establishing Virtuous Cycles

PlayMoolah sees a symbiotic relationship between financial well-being and preventive healthcare. Improved financial health leads to reduced stress, which positively impacts mental and physical health. In turn, better health enhances productivity and offers individuals possibilities to pursue multiple streams of income. This further solidifies one’s financial foundation. It is key to establish this virtuous cycle of financial health and resilience.

This virtuous cycle of financial health and resilience is also something that can be passed on through generations. By building and modelling a financially healthy household, parents are instilling in their children the importance of having a strong foundation to build their future. This would lead to the next generation being more financially resilient and mature. Society also benefits from having more responsible and emotionally regulated stewards of financial resources. We become a more responsible society, perhaps a more just and equitable world as we tackle this financial divide. As part of the larger social health concern, can we find new paradigms to shift from social mobility to social flourishing? Taking the lens of FER as preventive healthcare proposes a new way of looking at decisions in a more holistic way, our individual social health, our families, our communities, our nation, our world and planet can hopefully be more just and equitable for all.

Government and Corporate’s Role and Advocacy

Governments and corporations play a pivotal role in cultivating financial well-being as preventive healthcare. Policymakers can implement policies and regulations that promote fair lending practices, consumer protection, and accessible financial literacy education. Employers can provide resources such as financial wellness programs and retirement planning assistance to their employees, in addition to employee assistance programs. This would create a more fulfilled and resilient workforce.

In Singapore alone, a report by healthcare consultancy firm Asia Care Group on behalf of health insurance and services company Cigna, found that Singapore spends about US$2.3 billion (S$3.1 billion), or 18 per cent, of its total healthcare expenditure on stress-related illnesses annually.” Straits Times went on to share that, “The nation's proportion of expenditure on stress-related illnesses second-highest out of the nine regions studied in the report, coming just 0.8 per cent behind Australia's 18.8 per cent. The other seven regions were Hong Kong, South Korea, Taiwan, Thailand, United Arab Emirates, the United Kingdom and the United States.”

What this means is that Corporations and Governments across the world have a huge role and responsibility to tackle this challenge and be mindful of the hidden costs of financial stress and mental wellbeing across the next decade.

Conclusion

Financial Emotional Resilience has deep and far-reaching impacts on individuals, families, organizations and society. While it is a nascent concept, PlayMoolah is committed to developing this concept further through our strategic programs, products, partnerships, and initiatives, and to emphasize the importance of cultivating financial emotional resilience in our everyday lives and across personal and professional capacities. When we build our inner reservoir of resilience and strength, we can embrace the vast horizons of possibilities in the future. We become undaunted by the challenges that arise. Instead, we are secure in the knowledge that we are resilient and antifragile. Join PlayMoolah in this journey to discover how to build your financial emotional resilience to design your flourishing life and play an instrumental role in designing a thriving future, society, world, and planet.

This article is written by Audrey Tan in collaboration with Geraldine Wee and Lisabelle Tan.

Sign up to our newletter

Keep up with Playmoolah's latest news and offers!

Thank you for subscribing to our newsletter, you will be updated with the latest news and offerings from us. If you’d like to make an enquiry, feel free to contact us here.

Learn more about Financial Emotional Resilience by downloading our guide on “Cultivating Financial Emotional Resilience for a Flourishing Life” here. It’s free!

Who we are

PlayMoolah enables Financial Emotional Resilience® for a Flourishing Life

A Brand of The Moolah Group

A Partner Company to The Wealth Resilience Institute

A Brand of The Moolah Group

A Partner Company to The Wealth Resilience Institute

Get in touch

-

10 Anson Road, #44-12,

International Plaza,

Singapore 079903 -

info@playmoolah.com

Copyright © 2025