What would a flourishing life look like? If we had all the money in the world, what would we be doing with our lives? For too long we have focused on financial, social and intellectual capital in society as the measure of success, but really, is that all to life?

Empty space, drag to resize

Research has shown that Money is the source of anxiety and stress for many. Money creates its own emotional challenges eg: guilt when impulse spending happens, the fear that leads to an avoidance of money, hopelessness in one’s financial situation in some cases. A Blackrock survey in 2019 states, “More than half (53 per cent) of Singaporeans cited money as the top source of stress, and this concern is particularly key among millennials (63 per cent).”

We need to first begin by understanding the gap in the current financial education landscape. We see that despite best efforts to provide greater technical education about money, the effectiveness of such programs is still in question. Why then is money still such a heavy stress factor? Why are people unable to apply the lessons of financial literacy? Why then do we insist on using the same old approaches in addressing financial illiteracy?

Empty space, drag to resize

Daniel Goldman defines Emotional intelligence as, “the capacity to be aware of, control, and express one’s emotions, and to handle interpersonal relationships judiciously and empathetically.”

The OCED defines Financial literacy as, “the knowledge and understanding of financial concepts and risks, as well as the skills and attitudes to apply such knowledge and understanding in order to make effective decisions across a range of financial contexts, to improve the financial well-being of individuals and society, and to enable participation in economic life.”

Our work at PlayMoolah has shown us that it’s the combination of building the Financial-Emotional resilience muscle that will enable us to practice sustained behavioral change. We define Financial Resilience as the ability to adapt, change, modify positive emotions, daily practices and actions in our financial decisions. Imagine yourself at the gym, training this muscle, recognizing that you have the ability, strength to transform your situation where money intersects the many areas of life, relationships, vocational choices and even our future self.

Futurist Suhail Inayatullah explains, “The fourth layer of analysis is at the level of metaphor or myth. These are the deep stories, the collective archetypes, the unconscious, of often emotive, dimensions of the problem or the paradox (seeing population as non-statistical, as community, or seeing people as creative resources, eg). This level provides a gut/emotional level experience to the worldview under inquiry. The language used is less specific, more concerned with evoking visual images, with touching the heart instead of reading the head. This is the root level of questioning, however, questioning itself finds its limits since the frame of questioning must enter other frameworks of understanding — the mythical, for example.”

What is the significance of this? In order to change behaviors and sustained behavioral patterns over time, we need to tackle the myth and metaphor layers to challenge negative money narratives or emotions to re-write them to positive ones. We too need to understand the role of emotional regulation and virtues in action where financial decisions are concerned.

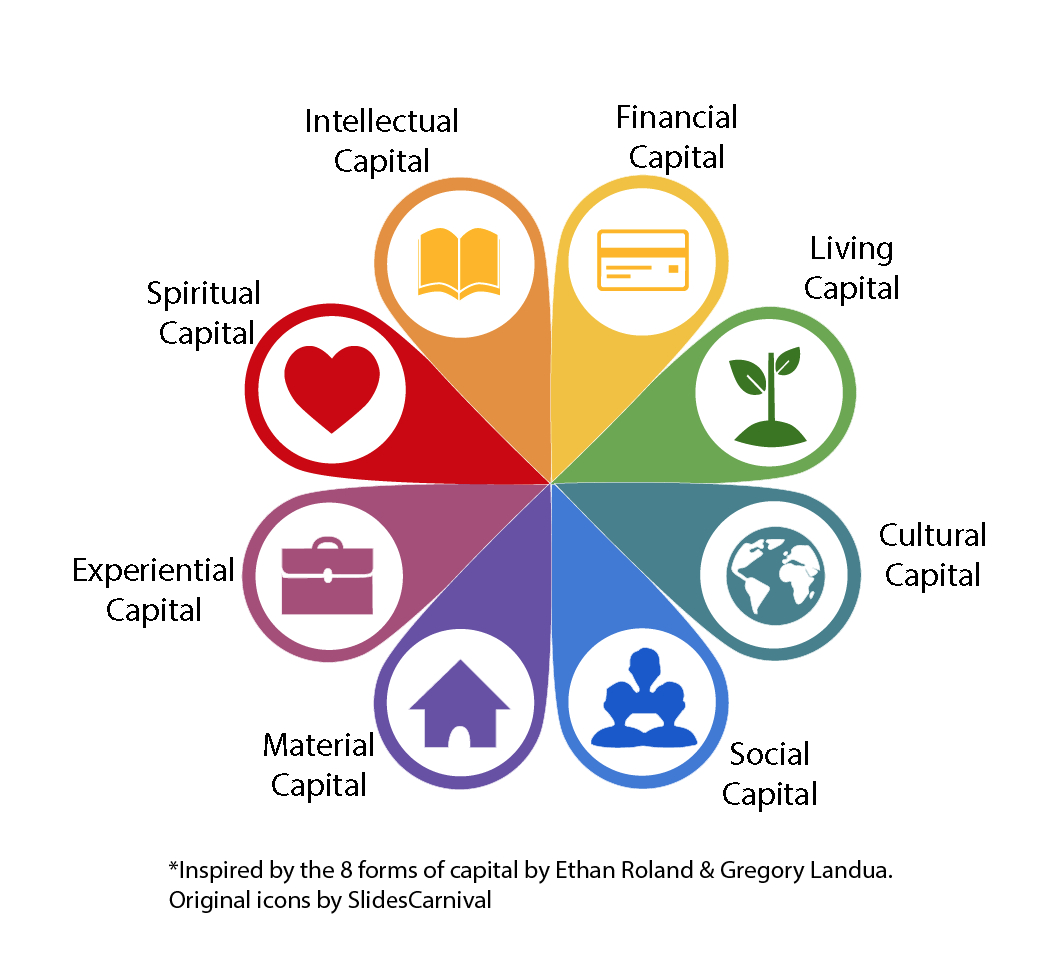

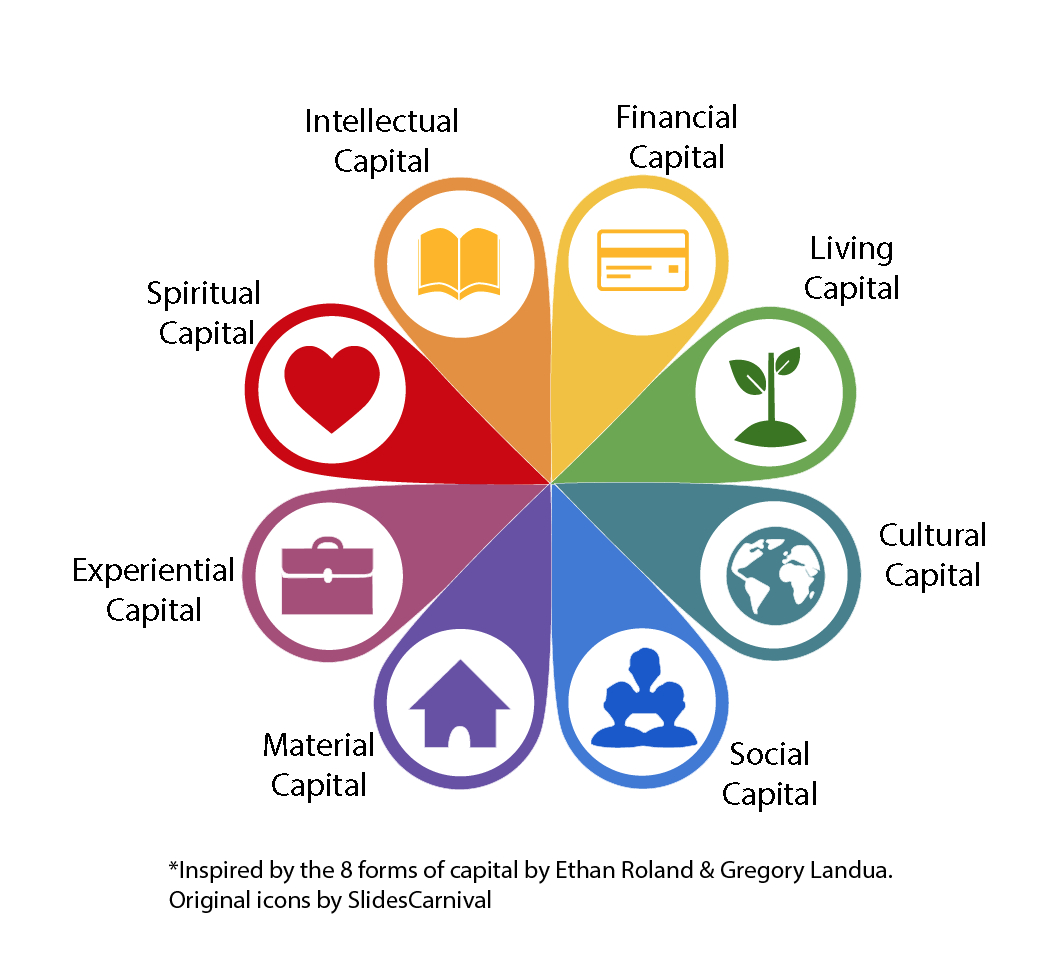

Once we’ve managed to restructure our money narratives, only then can we begin the process of formulating more authentic narratives — namely, recognizing the 8 forms of capital.

Permaculture has shown us when we use the 8 forms of capital as a broader, integrated and strength based approach of wealth, we come closer to a holistic flourishing life.

We know that in today’s society, the accumulation of financial, social and intellectual capital have been given pride of place as “the measures of success.” Consciously or unconsciously, these dominant societal narratives along with the inherited money narratives from our families (stories we inherit from the previous generation) largely shape the way we relate to money in the present.

In order to begin living the flourishing life, we must begin to re-examine our definition of wealth.

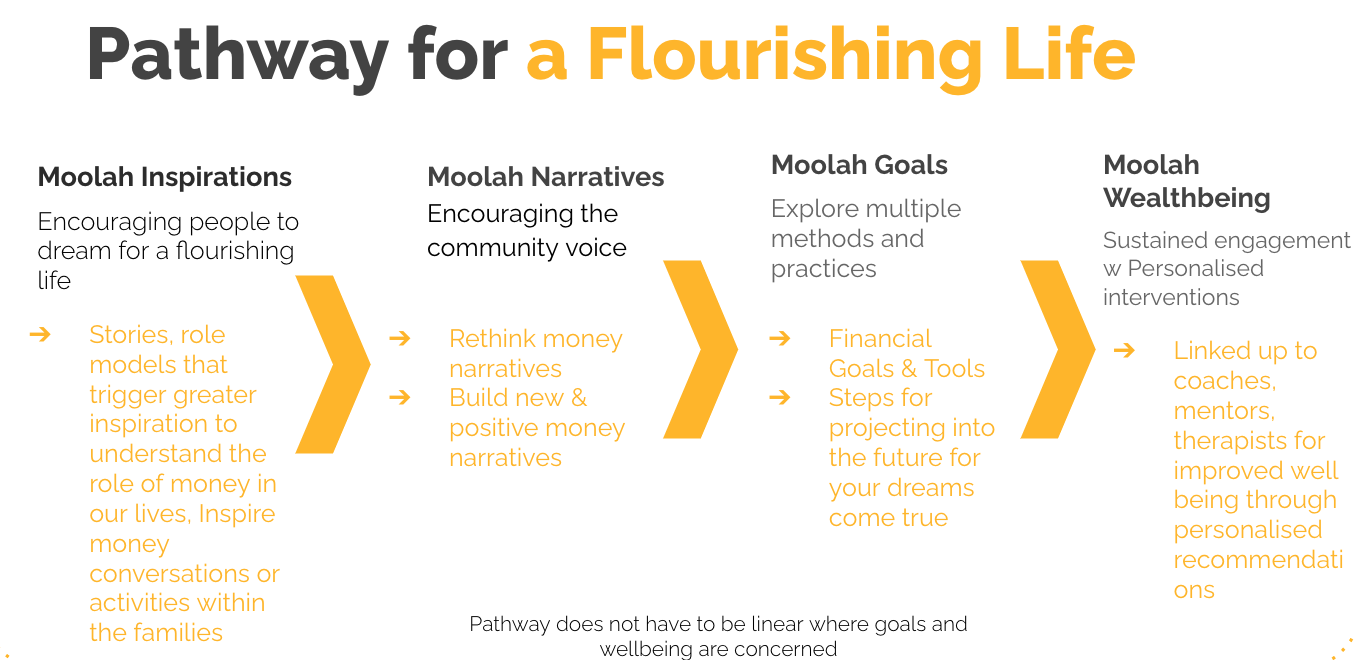

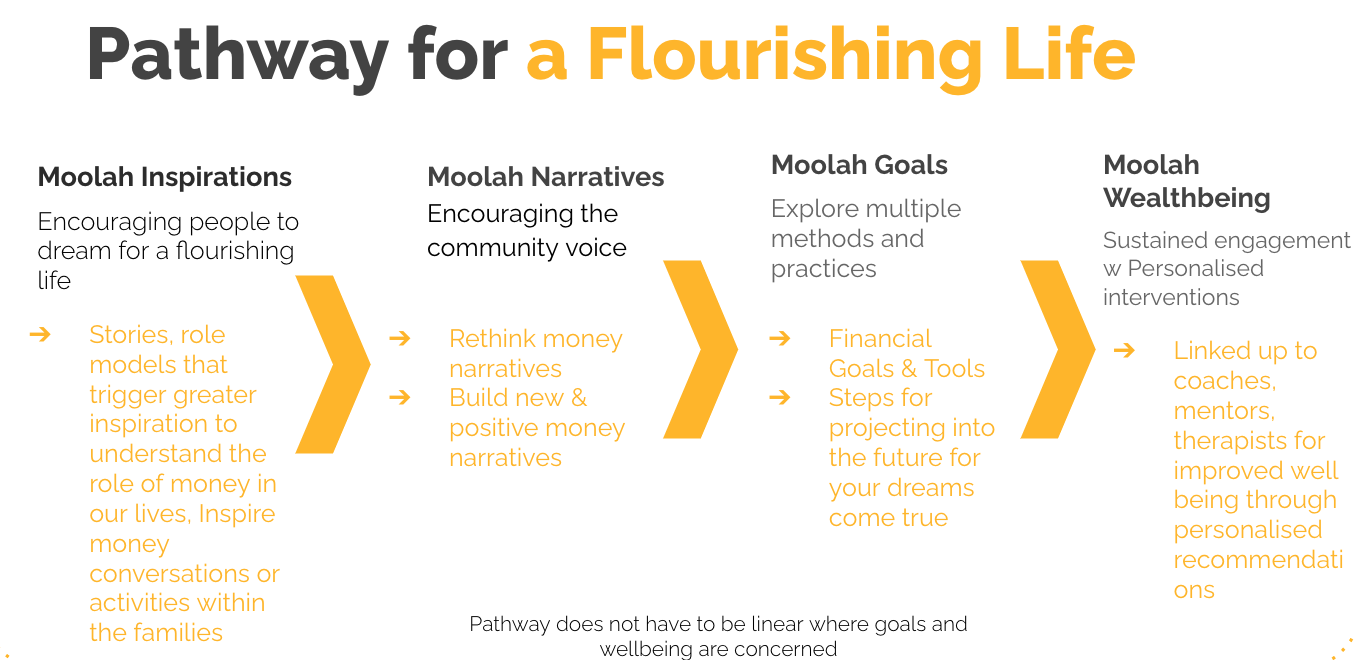

We do that through:

-

Bringing the unconscious to the conscious through art and data

-

Transforming money scripts to have positive money narratives

-

Financial-Emotional Quotient diagnostics that helps us to understand our money behaviors, actions and blind spots around money

-

Personalised content to curate just in time learning & content to make it most relevant to you

Our goal is to equip young people, families, educators and communities with the foundation skills in managing their emotions and this includes the following: emotional literacy, flexible thinking, self-compassion, tolerating discomfort associated with delay gratification, making sound decision making based on intention rather than emotions and values identification. At the same time, equip our young people with the habits of mind, mental models to develop skills to practice self control, practical strategies to make good decisions and have productive money conversations.

These are skills that one can learn and master so that when unexpected challenges arise, they will have the financial-emotional resilience to keep moving towards their goals. With stronger financial-emotional resilience we can live emotionally sober, free and dignified lives that we are called to live. To put money in its place and really start living the best and flourishing life!

For the full version of our paper on Financial-Emotional Resilience, head over to our

Home Page and download the full guide.