Here is an example of what a budget of a 3rd year engineering student with an allowance of S1,000 per month, Umairah, looked like:

As can be seen, her monthly total is $249.44 * 4 = $997.76, which is very close to her monthly “income” (allowance plus tuition earnings) of $1,000. Although she is not saving any money every month, the good thing is that she is not spending beyond her “budget.”

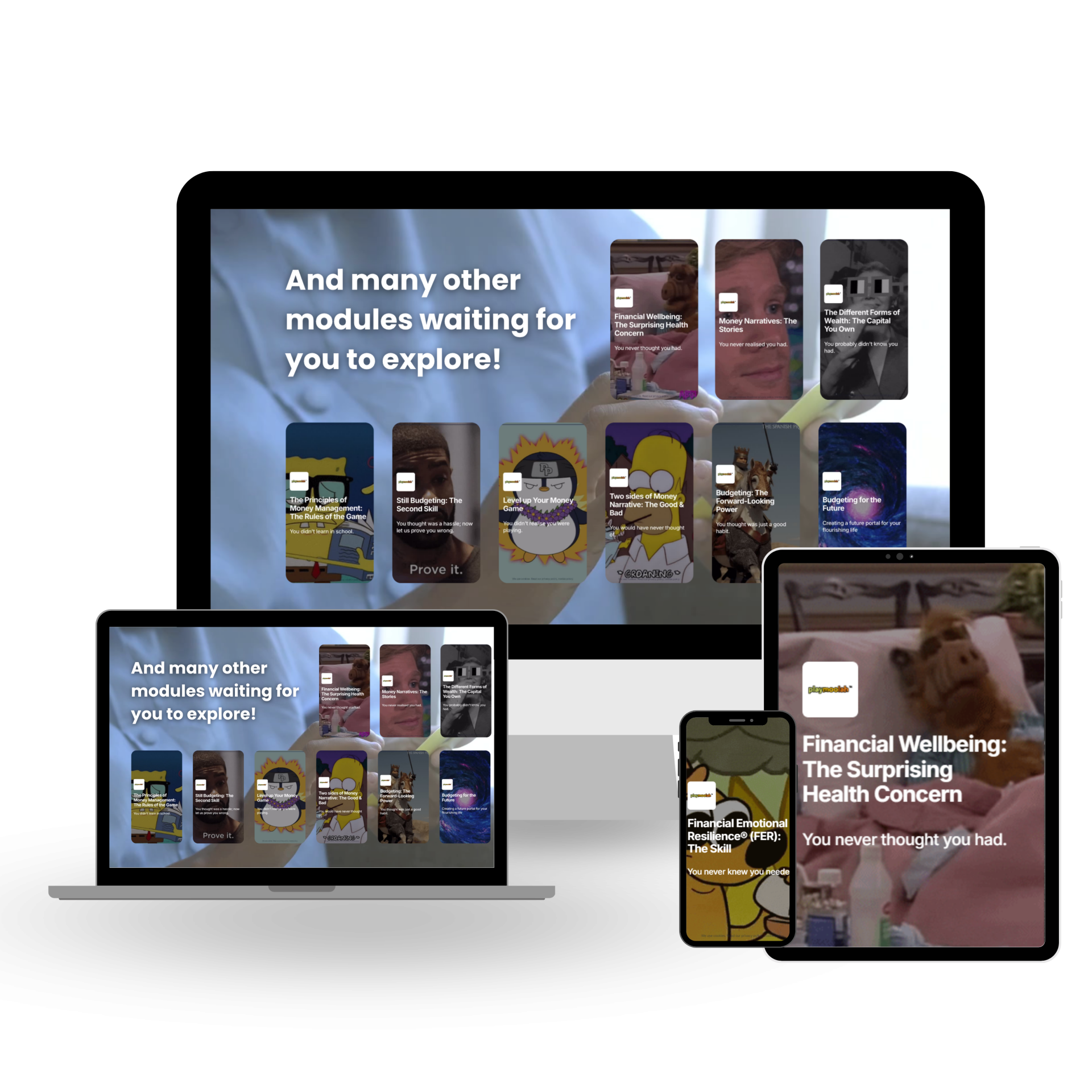

After learning the budgeting life hacks and tips in the Financial Wellbeing - Introduction Course, she made the certain adjustments to her spending patterns and hence rework her budget.

After some optimisation, Umairah is able to save $59.70 per week! This works out to $238.80 per month, which could be used to build her emergency funds or for her to kickstart her investment journey.

Most importantly, Umairah’s quality of life has not been significantly impacted – she still gets her favourite coffee, fast food, and restaurant meals!

Umairah's grand total monthly expense is $758.96. This is below her $1,000 'income', leaving her

$241.04 to save.

As she has learnt earlier, Umairah used Life Hack #1 - Pay Yourself First and saved 10% of her allowance/income first ($100) instead of waiting for leftovers at the end of the month. If she follows her budget strictly, she will have $141.04 more to save ($241.04 minus the $100 she dedicates to save).

Per

Life Hack #2 - Automate the Saving, Umairah also makes it so that she doesn’t “see” this 10% of the money saved as being available in her savings account and works within the remaining budget.

👉 Here's the Budgeting Sheet for you to try out today:

DRIVE.

See you again soon.

With gratitude,

Audrey and the PlayMoolah Team