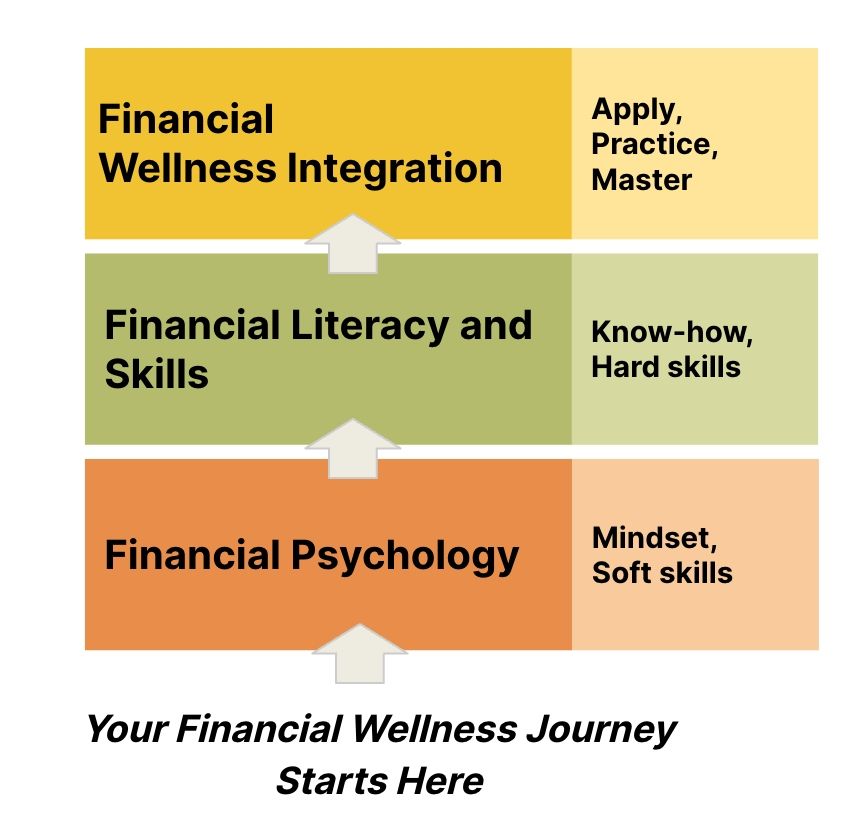

Financial Wellbeing - Introduction

The Art and Science of Investing

Thank you for contacting us, we look forward to connecting with you soon.

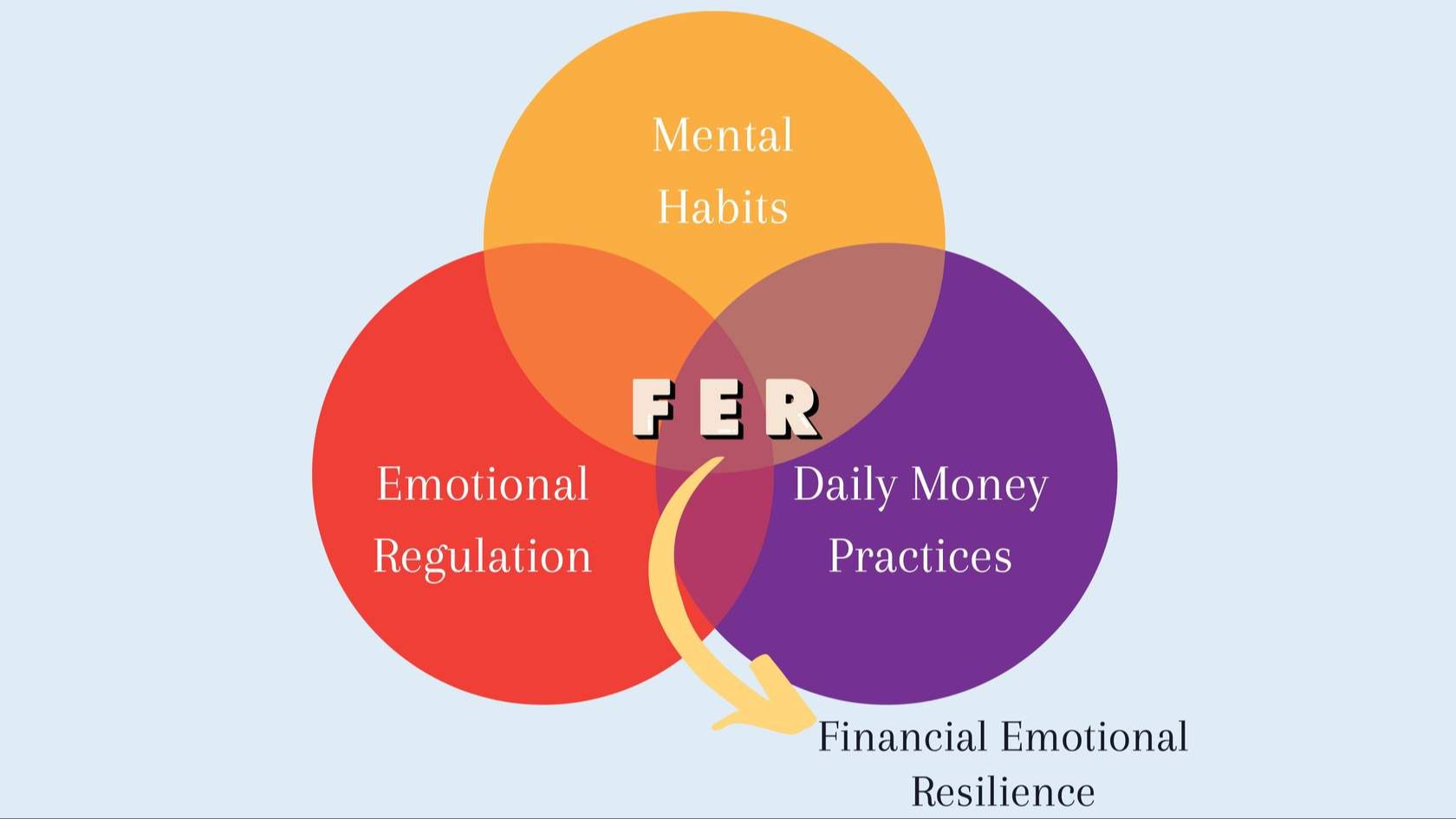

Learn more about Financial Emotional Resilience by downloading our guide on “Cultivating Financial Emotional Resilience for a Flourishing Life” here. It’s free!

Learn more about Financial Emotional Resilience by downloading our guide on “Cultivating Financial Emotional Resilience for a Flourishing Life” here. It’s free!